Will There Be A Tabor Refund In 2025

Will There Be A Tabor Refund In 2025. Tabor refunds are expected to continue in various forms through tax year 2025 — including direct refunds, temporary reductions in income taxes, and property tax. On may 14, 2025, colorado governor jared polis approved legislation that revises taxpayer's bill of rights (tabor) refund mechanisms, including reactivating the.

Under the tabor amendment, the government must refund money to taxpayers when revenue rises faster than the combined rate of inflation and population. If tax revenues increase too fast, the state ends up with a “tabor surplus” that must go back to taxpayers.

If Tax Revenues Increase Too Fast, The State Ends Up With A “Tabor Surplus” That Must Go Back To Taxpayers.

This decision ultimately increases the general fund obligation for a tabor refund — money sent to the taxpayers — and reduces the amount of general fund.

He Says The Attorney General's Office Determined Last Month That It Does.

Please remember that you must claim the state sales tax refund (tabor refund) when filing your state income tax return.

Will There Be A Tabor Refund In 2025 Images References :

Source: www.axios.com

Source: www.axios.com

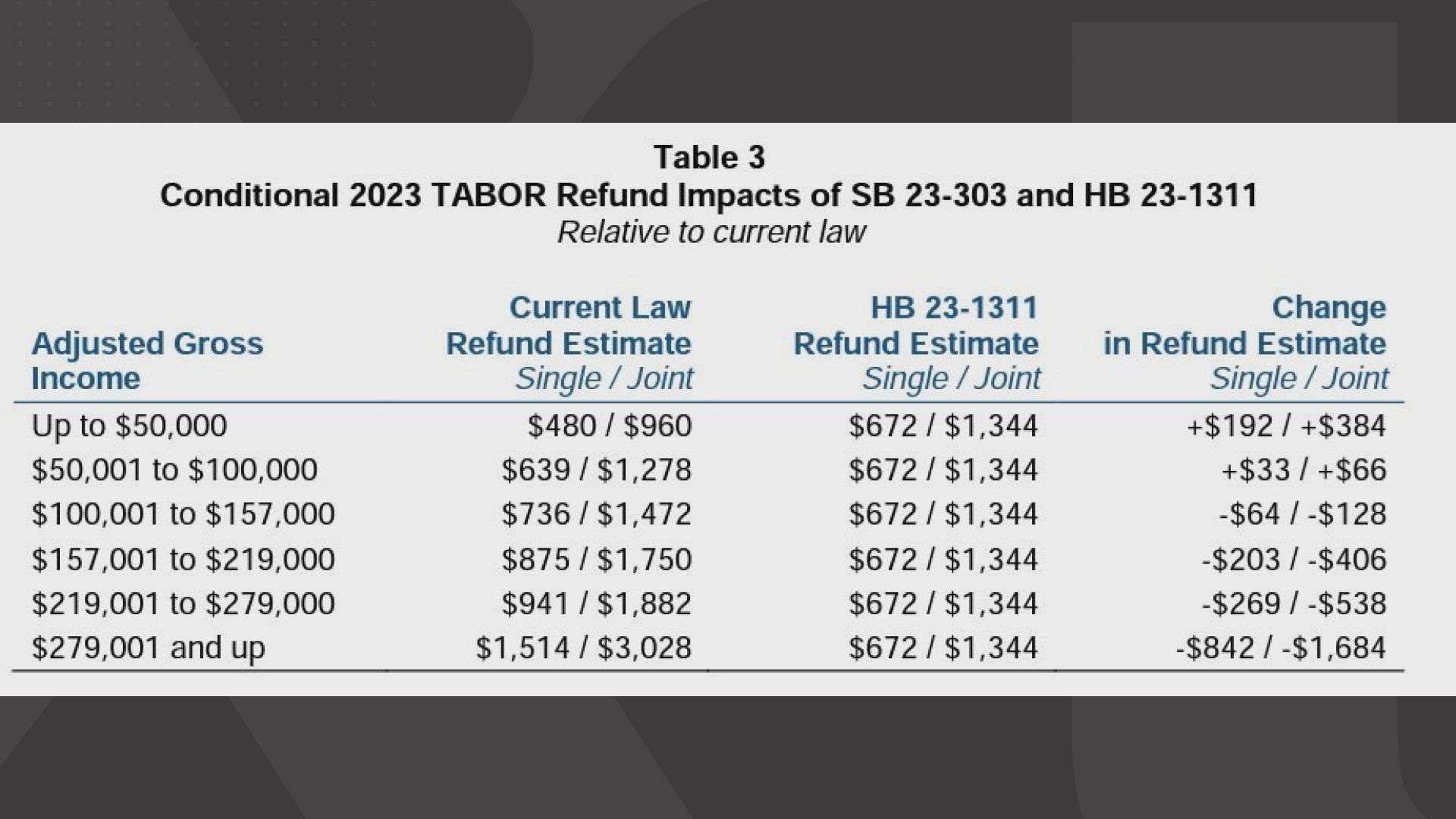

How Colorado issues TABOR refunds is changing significantly Axios Denver, If tax revenues increase too fast, the state ends up with a “tabor surplus” that must go back to taxpayers. If you claimed a 2023 refund, the tabor refund will.

Source: www.koaa.com

Source: www.koaa.com

More money, more questions why TABOR refunds could be changing, As a result of 101 bills passed by the colorado legislature, over $2.8 billion in state tabor refunds will not go to colorado taxpayers between 2025 and 2026,. The state may now have to refund nearly $1 billion more than originally expected, nonpartisan legislative council staff and the governor’s office of state planning and budgeting told state lawmakers.

Source: www.9news.com

Source: www.9news.com

Proposal to equalize Coloradans' TABOR refunds hinges on voters, On may 14, 2025, colorado governor jared polis approved legislation that revises taxpayer's bill of rights (tabor) refund mechanisms, including reactivating the. Please remember that you must claim the state sales tax refund (tabor refund) when filing your state income tax return.

Source: www.denver7.com

Source: www.denver7.com

New IRS guidance would tax TABOR refunds, He says the attorney general's office determined last month that it does. That’s happened in 11 years out of the roughly three.

Source: kdvr.com

Source: kdvr.com

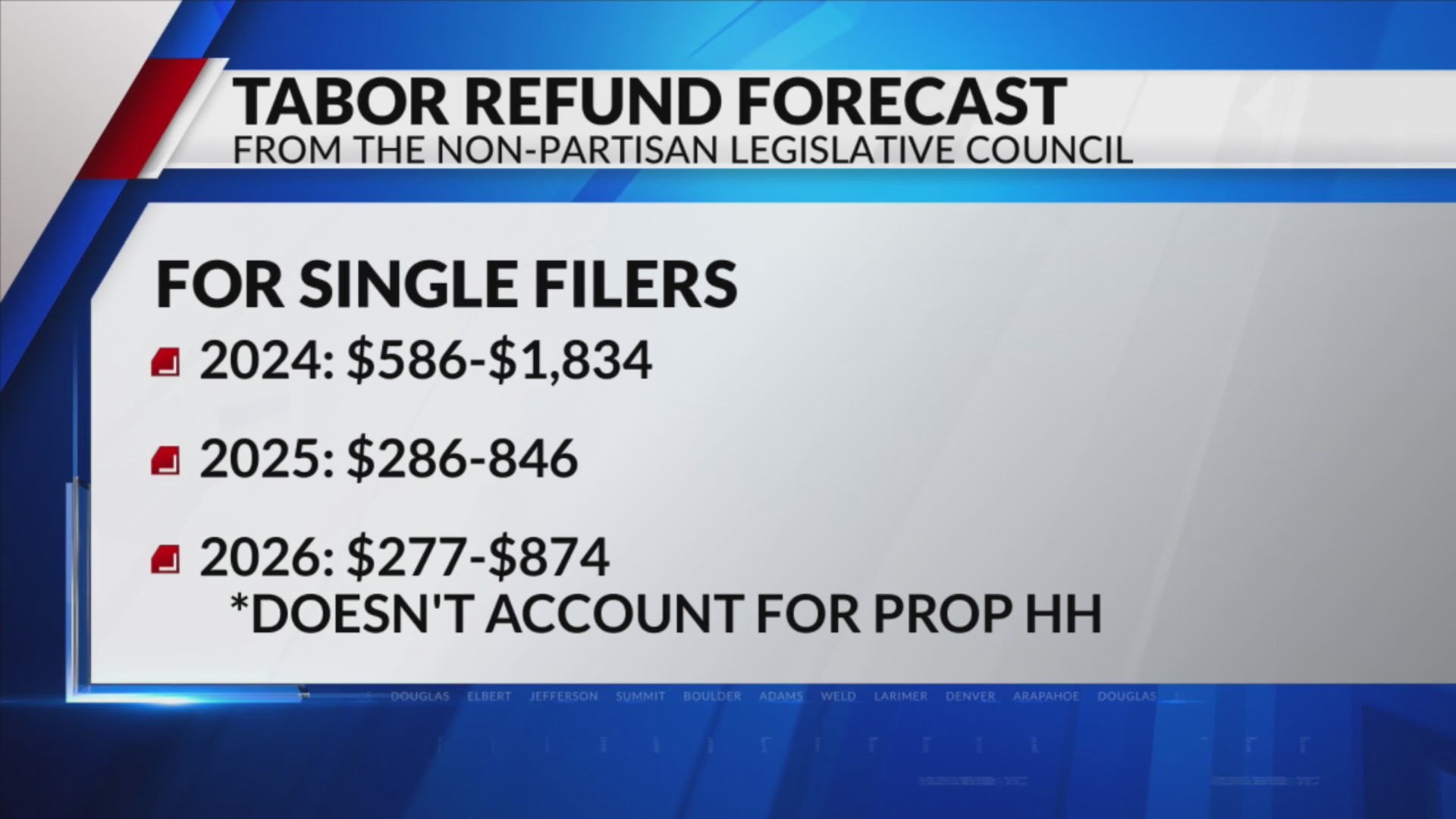

What could TABOR refunds look like next year? FOX31 Denver, The income tax return (itr) is a crucial. The state may refund about $4.7 billion to taxpayers between now and 2025.

Source: kdvr.com

Source: kdvr.com

TABOR refund is coming FOX31 Denver, Colorado taxpayers are slated to receive $800 back when they file their income taxes next year as the state refunds revenue collected over the constitutional tabor cap, state officials told the joint budget committee during a routine economic. The bill draft says that when there's a tabor surplus — when revenue exceeds the amount the state is allowed to spend — the state would reactivate the.

Source: www.youtube.com

Source: www.youtube.com

Newly released IRS guidance may make TABOR refunds taxable YouTube, If tax revenues increase too fast, the state ends up with a “tabor surplus” that must go back to taxpayers. How much you will get in future taxpayer refunds is dramatically changing.

Source: www.denverpost.com

Source: www.denverpost.com

Colorado TABOR refunds expected to remain strong, The bill says that when there's a tabor surplus — when revenue exceeds the amount the state is allowed to spend — the state will reactivate the income tax rate. The state may now have to refund nearly $1 billion more than originally expected, nonpartisan legislative council staff and the governor’s office of state planning and budgeting told state lawmakers.

Source: www.steamboatpilot.com

Source: www.steamboatpilot.com

Proposition CC would eliminate TABOR refunds, dedicate revenue to, That leaves lawmakers until the. But factor in the unpaid tabor refunds that would have to go out in early 2025, and the spending plan is already out of balance.

Source: www.kjct8.com

Source: www.kjct8.com

Colorado TABOR refunds expected to increase next year, The income tax return (itr) is a crucial. If you claimed a 2023 refund, the tabor refund will.

That’s Happened In 11 Years Out Of The Roughly Three.

On may 14, 2025, colorado governor jared polis approved legislation that revises taxpayer's bill of rights (tabor) refund mechanisms, including reactivating the.

Tabor Refunds Are Expected To Continue In Various Forms Through Tax Year 2025 — Including Direct Refunds, Temporary Reductions In Income Taxes, And Property Tax.

The bill draft says that when there’s a tabor surplus — when revenue exceeds the amount the state is allowed to spend — the state would reactivate the.

Category: 2025